Written by Christopher Dang, Economic Development Research Intern | Economics to predict recessions

If you were curious to see who you will marry and how your life will turn out, you go and see a fortune teller or a psychic. However, if you were wondering when the next recession is going to hit, you may find yourself looking at the yield curve.

The yield curve is known to have accurately predicted every recession in the past 60 years.

For this reason, it has been a big topic on Wall Street, with some worrying about what the current yield curve portends. But before diving into that, let’s first discuss what exactly the yield curve is.

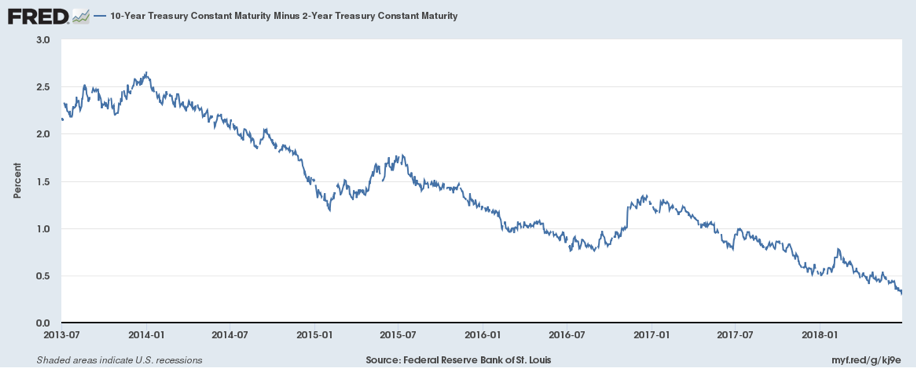

The mechanics of the yield curve are quite simple; the yield curve is a way to visualize the difference between short-term and long-term rates on US government bonds. The curve is a line that plots yields across all debt maturities and typically tends to slope upward. Generally, short-term rates are lower than long-term due to the risk that strong economic growth could cause inflation and erode investment earnings over time. However, as of lately, long-term bond rates have been rising slowly, suggesting that traders may be skeptical about long-term economic growth. Simultaneously, the Federal Reserve has been raising short-term rates, and in return, causing the typically upward sloping curve to flatten out.

Currently, the gap between two-year and 10-year US Treasury notes is approximately 0.34 percent, or 34 basis points. The last time it was at these levels was in 2007, when the US economy was heading into one of the worst recessions in the past 80 years. This is when people start becoming cautious. So, you may be wondering “Does this mean we are doomed? Will history repeat itself and spiral us into another recession?!” And well… not quite.

Image Source: https://fred.stlouisfed.org/series/T10Y2Y

Image Source: https://fred.stlouisfed.org/series/T10Y2Y

There are many analysts who are providing reassurance by saying that we should not fret too much about the yield curve until it starts to become inverted. Chief Investment Strategist at BMO Capital Markets, Bryan Belski went on by saying, “From our perspective, the only time investors should worry about the yield curve implications is (if) when it inverts.” The question thus rests on whether the yield curve will begin to become inverted and inevitably thrust the economy towards a recession.

Vice President of AngelouEconomics, William Mellor, tuned in on a recent Trend Tuesday video addressing the issue. Mellor stated that there are a few things that make our economy different now compared to previous years where a recession followed a flattening yield curve. The US economy is relatively strong, characterized by an 18-year low unemployment rate, accompanied with high capital investment and consumer spending. However, not everything is exactly smooth sailing. Inflation continues to be low, the stock market has been quite volatile, and foreign allies’ economies have not been growing at a rate we want.

An important factor to consider when talking about the yield curve are peoples’ perception of what the curve entails. When investors start to show concerns of an incoming recession, they will most likely invest more money into the safety of long-term bonds. This move will inadvertently help flatten, and perhaps even invert the yield curve. Investors’ fear of the yield curve’s history turns it into a self-fulfilling prophecy.

Any economist who confidently says whether the US economy is heading towards a recession or not may warrant some skepticism.

The best thing we can do at the moment is to not worry too much, and to stay tuned in with AngelouEconomics to receive updates on what the yield curve continue tells us.

Image Source: http://t2conline.com/wp-content/uploads/2017/10/Wall_Street_NYSE.jpg

About AngelouEconomics:

AngelouEconomics has worked with numerous professional and business associations in building dozens of unique economic impact studies among other types of projects including site selection projects as well as strategic economic development projects. Some projects have examined the effects of statewide policy measures, such as the Texas Bathroom Bill or ban on Sanctuary Cities. Other projects have measured the contribution of member networks in terms of jobs, wages, and total economic output. Like this study for Prospera, a nonprofit organization which specializes in providing bilingual assistance to Hispanic entrepreneurs in Florida. Economic impact studies are effective tools for quantifying and illustrating the value of individual professional and business associations. They are versatile, as they can illustrate the value or impact of a specific policy or quantify the economic contribution of your members to the local, regional, and nationwide economies.

Want to Learn More?

If you would like to learn more send us an email at info@angeloueconomics.com